Where to watch 2025 kitten bowl live: start time, tv channel and online streams

Before the 2025 Super Bowl kicks off, there’s another...

Canada Vs USA Hockey Rivalry Series Live Streaming: Tv Channel, preview for Final

The stage is set for an epic showdown as Canada’s National...

Harry and Meghan Invictus Games 2025 Live Broadcast on February 8

The 2025 Invictus Games, the inspiring international...

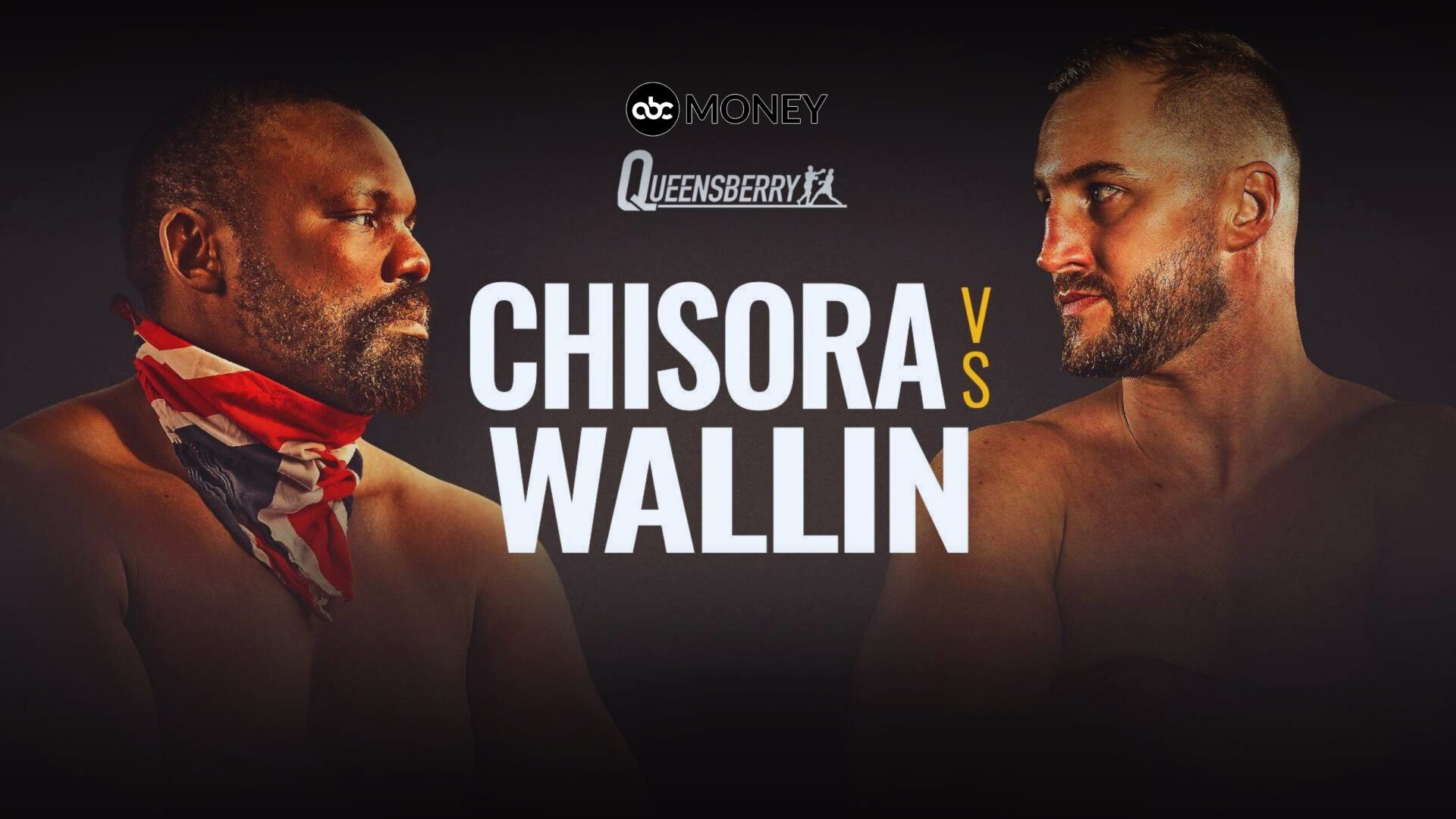

Chisora vs. Wallin Live: Start Time, Date, Fight Card, How To Watch

The boxing world is abuzz tonight as veteran fighter Derek...

England vs. France Live: Six Nations 2025 | TV channel, streaming, kickoff time

The Six Nations Championship is one of the most anticipated...

Italy vs. Wales Live: Six Nations 2025 | TV channel, streaming, kickoff time

The 2025 Six Nations continues this weekend as Italy host...

Ensuring Security and Control While Using Non-GamStop Platforms

Online gambling can be an exciting and rewarding...

The Rise of Crypto Transactions in Online Gaming: Rolletto’s Approach

Rolletto Casino is making waves as one of the most exciting...

The High-Stakes Advantages of Velobet’s VIP Program

Online casinos have become a popular destination for gaming...

Types of Commercial Real Estate Suitable for Small Businesses

Starting a small business comes with many challenges, and...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin