Want To Begin Investing? Here’s Some Of The Basics To Get Started

Investing can be an exciting and rewarding way to make your...

Lloyds Online Banking: Complete Guide

The popularity of digital assets makes it automatic to...

Dow Jones Industrial (DJI) Stock Price Prediction

The Dow Jones Industrial Average (DJI), a time-honored...

New Trends in IT Contracting: Landing High-Value Contracts in a Competitive Field

The demand for skilled IT contractors is skyrocketing as...

Top 10 Blockchain Networks: The Ultimate Guide

Being a curator of knowledge and personal interest in...

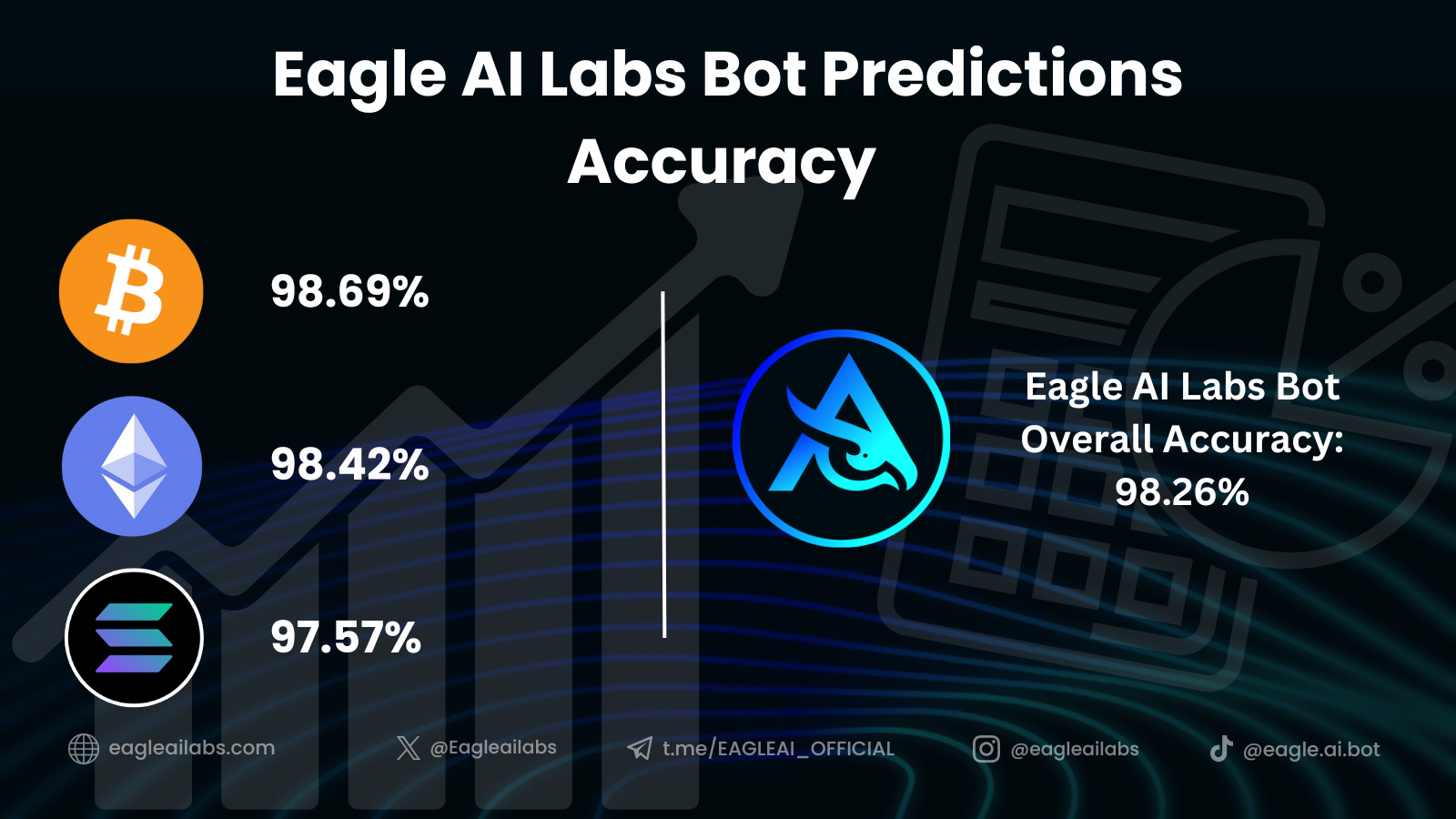

How Eagle AI Labs Transforms The Role of AI in Modern Trading with 98.37% Accuracy

Imagine making trading decisions with 98.37% accuracy....

Bitcoin Creator: 10 Secrets of Bitcoin Founder

Satoshi Nakamoto, a fictional creator of Bitcoin, is still...

Juan Espinoza’s Key Insights for Investment Success

With over two decades of experience in investment...

5 Best Bitcoin Alternative Crypto Coins

Recently, I have learned that there have been numerous...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin