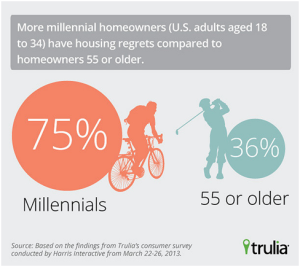

If you were to listen to the popular press, you could be forgiven for thinking that millennials belonged to a lost generation. From rising house prices and stagnant earnings to rising tuition fees and a so-called savings crisis, there is a sense that our millennials face a series of economic challenges that they are ill-equipped to overcome.

The spectre of Brexit has hardly helped this foreboding sense of doom, particularly amid talk that exiting the EU will increase prices and cost jobs.

How Millennials Have Greater Access to Advantage and Opportunity than Their Parents

There is a counter-argument, however, and one that cuts through the type of biased and unfounded journalism that has emerged in modern-day Britain. The cost of buying a home has grown at a far slower rate than in previous generations, for example, while the interest bill on an average Millennial property is less than half of that paid by their parents.

Similarly, the average mortgage repayment will account for just 31% of a Millennials’ earnings, compared with a staggering peak of 45% back in 1990.

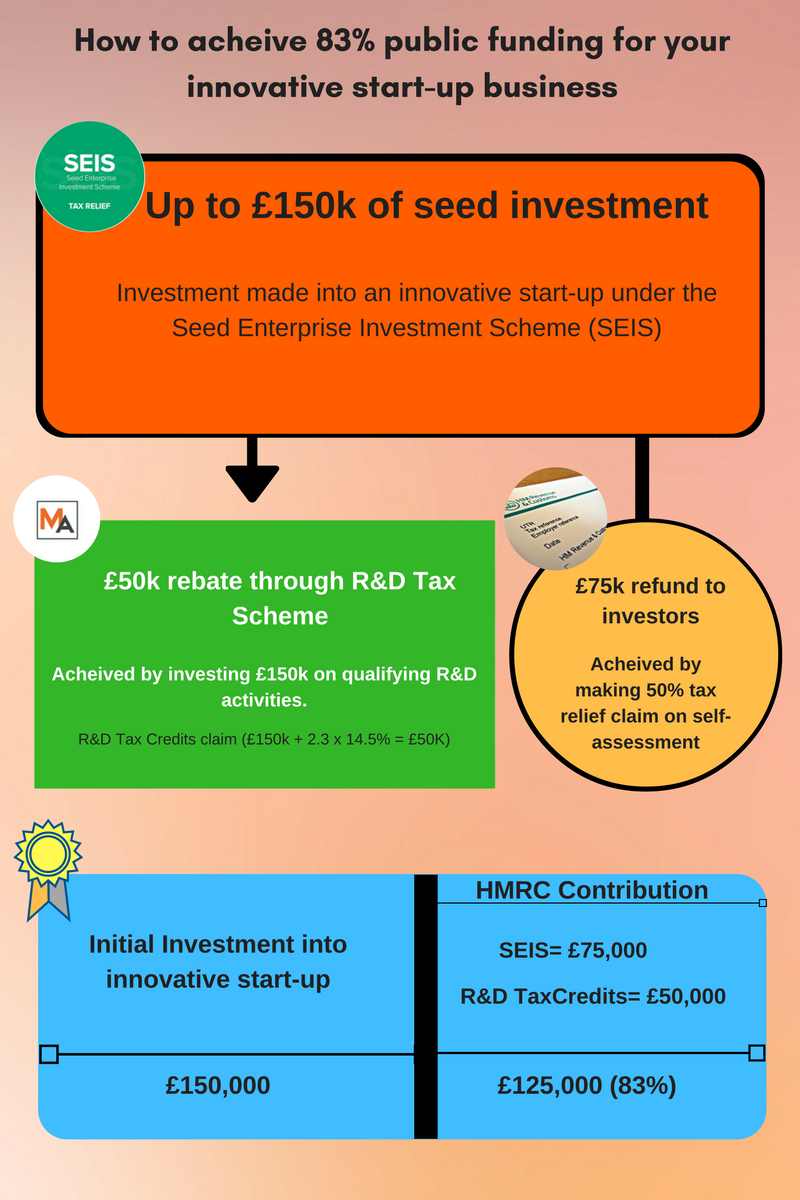

This is not all, either. Disposable income levels in the UK are higher than they were during the 1980’s and much of the 1990’s, for example, while the current government’s taxation policies mean that many Millennials are now paying less in levies than those who have gone before them. With graduates also under no obligation to repay their tuition fees until their earnings reach a specific threshold, the economic picture is also far rosier than initially meets the eye.

Beyond these unique advantages, Millennials also have access to unprecedented opportunities when it comes to earning money. This can largely be attributed to the online revolution, which has made it possible to augment a full-time income and build towards a brighter financial future. The key, of course, lies in understanding the opportunities available, and determining which would be most suited to your unique skill-set. Here are some examples: –

Sell your Assets on the Consumer Market

Whilst car boot sales have always been a great, and unskilled way, through which to pick up some extra cash by selling off your unwanted items there are now an incredible amount of ways that you can sell your things easily online. Online auction sites like eBay or sites like Gumtree are often the go-to places for listing your goods for sale and these incredibly convenient sites are a good way to get your items seen and sold quickly and effortlessly.

Websites such as Etsy are equally good places to get selling especially if you have homemade products that you crafted yourself. Most of these sites will charge a small fee if sold, however for their convenience and exposure they are well worth your while.

Market and Sell Your Services

If you have a particular skill or talent for something you may be able to market this and leverage it financially online. Sites like iWriter and Textbroker along with numerous other content-related sites can pay you for article work and other blog content. However almost any skill you have can be utilised on PeoplePerHour or Fiverr, offering a similar outlet for less heralded attributes and experience.

Whether you can create digital content, illustrate, post Tweets, share news, proofread, sing a song, do an impression or even just create a recipe you can always use these services to promote specialised skills and hopefully begin to pick up some extra work from it.

Monetising your Opinions Online

Whilst you can enjoy plenty of virtual gaming past-times like free roulette (where you can win virtual cash) there are just so many more productive ways to spend your time online and earn out of it.

Even if you don’t possess any skills you feel would be useful in an online environment, you will still be able to find plenty of ways in making money online simply by sharing your user experiences and your opinions. Survey sites work with several top brands and services and can offer you small cash payments or vouchers in exchange for your opinions, so long as they are honest and well-articulated.

Once you’ve found a legitimate site, such as MySurvey or CashCrate, simply sign-up and enter a few details about yourself and then you’ll be routinely paired with relevant surveys and subsequently paid directly into your bank account or via Paypal when your earnings reach a predetermined total.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin