Managing the performance of staff is a critical activity at every company. Employees are well recognised as one of the largest costs, but also the greatest asset. For fast-growing companies, talent management and the performance of that talent is even more important. At the end of each day, much of the organisational learning walks out of the door and it is critical that it comes walking back in the following day. Once a company scales beyond the initial founding team, the stability and success of a fast-growing company is hugely dependent on staff loyalty and performance.

Do traditional models of performance management software remain relevant for fast-growth, particularly high-tech or eBusiness organisations? How might new models or adaptations of traditional models deliver more effectively?

In this article we examine three models of performance management to explore how some fast-companies are adapting the process to suit their rapidly changing environments.

The Traditional Model

The performance management cycle is a structured process of employee review and development. While many companies and managers still rely solely on the end of year performance appraisal as a single “big bang” approach of the traditional method of managing individuals’ performance, this is now largely recognised as not matching best practice.

The “performance management cycle” has been evolving (slowly!) since the Industrial Age, and a model relying solely on the annual performance appraisal is no longer considered fit for purpose.

The Modern Model

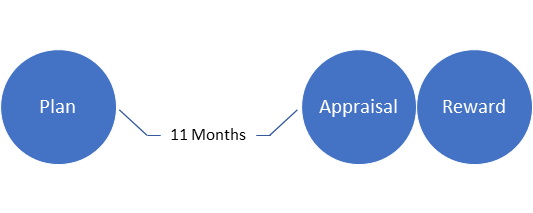

A more modern approach to the performance management cycle is made up of four core elements:

- Plan

- Monitor

- Appraisal

- Reward

This is often described as a four-stage model that starts with a performance development plan for the individual. The employee’s performance is monitored against the plan throughout the year with feedback given on a regular basis. At the end of the year, similar to the traditional model, there is an annual appraisal. The appraisal is separate from the “rewards” discussion which is held later. Once the cycle is completed any learnings are fed back into the system via the new planning stage for the following period.

This model differs from the traditional one primarily based on its use of regular communication and real-time feedback. Instead of taking the annual big-bang approach of doing everything together once a year, the modern approach seeks more regular (typically quarterly or even monthly) feedback throughout the year. This has been found to not only be more motivating and engaging for employees, but also improves performance because individuals can take action throughout the year based on their ongoing feedback.

This is also a more consultative and coaching oriented approach, focusing on developing employee’s strengths, rather than merely “skills-gap” analysis. Ideally the supervisor acts as a mentor to the employee rather than merely as judge. The supervisor takes ownership of coaching the employee into higher performance that has a higher probability of results being achieved, both for themselves and for the company.

The Fast-Growth Model

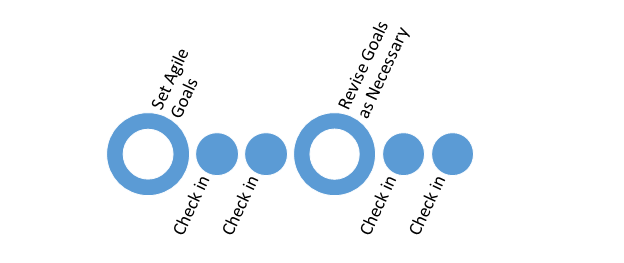

Yet is this model adaptable enough for companies whose business model, strategy and objectives often change throughout the course of the year? Fast-growth companies like Netflix and Microsoft have determined that a more agile model is required. In this model, an individuals goals have flexibility and may be adapted throughout the period based on changing market conditions or business strategy.

In this fast-growth model, while there is still a formal process, the process and objectives are highly adaptable and fluid. There is extensive use of informal “check-ins” between supervisor and employee to make sure that both parties are on the same page. These check-ins address questions around whether the environment or strategy has changed enough to warrant adaptations, and if the goals are still relevant.

The fast growth model makes extensive use of two-way real-time feedback, both from the supervisor and from the employee. As with the modern model, there is a substantial focus on coaching and development with a flexible and adaptive based approach using real-time feedback. Extensive use of the most recent data is used to provide evidence based feedback that can be trusted by both parties.

In summary, it is debatable whether even the modern model of performance management is fit for purpose with fast-growing companies. They need to be able to adapt and change course at short notice, which means their employees objectives need to adapt at the same pace or risk misalignment. For fast-growing companies that want to achieve the “golden thread” of aligning business strategy and objectives with employee’s goals and objectives, a more fluid model is necessary. Obviously the traditional model has no hope of achieving this. While the modern-model may be more effective, it is the final “fast-growth” model that makes the best use of regular check-ins that will have the greatest impact on maximising employee performance at rapidly growing organisations.