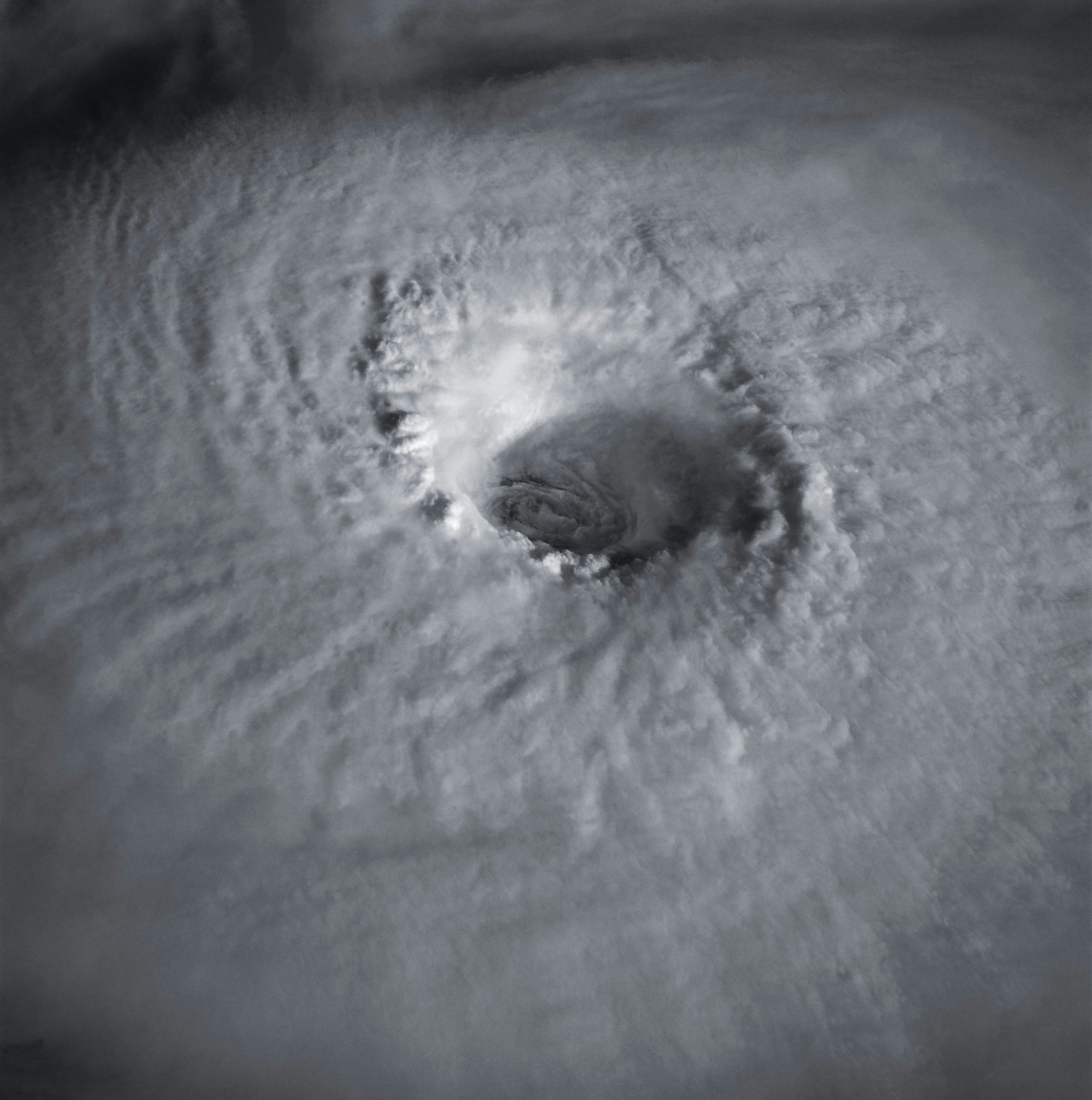

AccuWeather Estimates Hurricane Beryl’s Damage and Economic Loss in The U.S. at $28-$32 Billion

Hurricane Beryl caused severe storm surges along the coast...

Robert Walters Merges Brands Into a Unified Global Talent Solutions Company

Robert Walters announced today that it is consolidating its...

Reed Donates £10,000 Weekly to Charity For a Year In Honor of Founder’s 90th Birthday

In honor of Reed’s 65th year in business and Founder...

John Lamb Hill Oldridge Introduces Advisory Team for Insurance Based Investment Products

Prominent financial advisory firm, John Lamb Hill Oldridge,...

Despite Election Uncertainties, the CEO of deVere Group Justifies Market Optimism

The S&P 500 reaching its 35th record high this year...

Political Turmoil In France and Upcoming Rate Cuts Indicate Potential Euro Volatility, Says deVere CEO

The euro may experience turbulence throughout 2024 due to...

EIF invests €350 million in Spain-based Kembara

EIF invests €350 million in Spain-based Kembara, a Deep...

Highlighting Mental Health: Understanding Its Impact on NHS Employee Absences

Uncovering the Causes of NHS Staff Absenteeism: Psychiatric...

UK Stocks Expected to Soar This Year – Labour’s Victory Not Attributed As the Reason

UK stocks are anticipated to achieve substantial gains...

Pendleton Court Care Home hosts ‘Dancing Through the Decades’ event for Care Home Open Week 2024

Pendleton Court Care Home celebrates ‘Dancing...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin