The U.S. Startup That’s Using AI to Design Viruses—And Getting Pentagon Funding

There has always been a tense rhythm to the relationship...

Security Startup Funding Explodes to $38M for Fig

Fig Security raised $38 million Tuesday. The security...

Why Alejandro Betancourt Bets on Regulated Industries That Scare Other Investors

Alejandro Betancourt López, chairman of O’Hara...

Canada’s Quiet AI Boom Is Now Threatening Its National Power Grid

The hum is continuous on a gloomy morning in the north end...

Why the U.S. Department of Energy Is Investigating 5G Tower AI Collisions

The phrase “5G tower AI collisions” has a...

A Nationwide Sprint Outage in the U.S. May Have Been an AI Failure

Phones all over the United States started to go silent late...

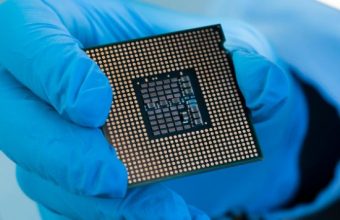

The Hidden AI Chip Supply Chain That Begins in South Wales

Artificial intelligence stories typically start in...

Tom Zendaya Wedding Rumors Explode After Stylist’s Shocking Claim

Fittingly, the rumor about Tom Zendaya’s impending...

UK Iran Crisis: Is Britain Drifting Into Another Middle East War?

They were short bursts across the Mediterranean sky. From...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin