Who Is President of Iran? The Doctor-Turned-Politician Suddenly at the Center

Old stone, new glass, posters, slogans, and the...

Is the UK Safe from War — Or Already on the Front Line?

Britain is not officially at war. Drone swarms and missile...

Lunar Eclipse 2026: Why This Blood Moon Feels Different

The peculiar aspect of a lunar eclipse is how unremarkable...

Did Iran Hit USS Abraham Lincoln? The Missile Claim That Shook the Gulf

The accusation came with a vengeance. After the USS Abraham...

Jenna Ortega Actor Awards: From Scream Queen to Awards Season Powerhouse

This year’s 2026 Actors Awards carpet felt...

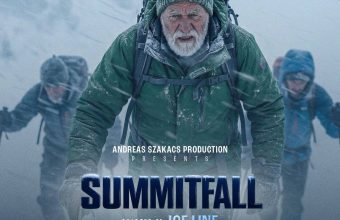

Andreas Szakacs Establishes Production Company and Commences Filming of Original Series Summitfall

Internationally acclaimed actor and director Andreas...

SMEs Get Funding in Days, Not Months, With Empire Lending’s Streamlined Approach

Small and medium-sized enterprises (SMEs) face their...

Dealing With Carpet Moths Before They Ruin Your Carpets

In the UK, we have carpet moths. Be aware of them! Even...

Lufthansa Group and the Logic of Consolidating a Made in Germany Approach

In an airline industry defined by razor-thin margins,...

CaseOh Net Worth: How a Gamer Turned Livestreams Into Millions

Somewhere in America, a small room is illuminated by a...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin